Stablecoins are unique in the cryptocurrency space due to their inherent properties, which are characterized by price pegs to a specific reference asset, typically a fiat currency such as the U.S. dollar or euro. The purpose of this peg is to mitigate the volatility common in digital currency markets.

The importance of stablecoins in the cryptocurrency space cannot be underestimated. They play a key role in measuring market fluctuations and are an important way to identify investment profit opportunities.

Stablecoin Analysis: Key Metrics

Stablecoin exchange balance

Stablecoin exchange balance

A key metric to consider is the balance of stablecoins held directly by exchanges. Stablecoin assets held by exchanges serve a variety of purposes, including providing emergency liquidity, facilitating over-the-counter (OTC) trading, and as a strategic tool to mitigate currency risk.

Analyzing the types of stablecoin assets held directly by exchanges can provide valuable insights into an exchange’s operating practices and strategies. Analyzing specific stablecoin assets can reveal how well an exchange is performing, including assessing liquidity, market trends and monitoring volatility.

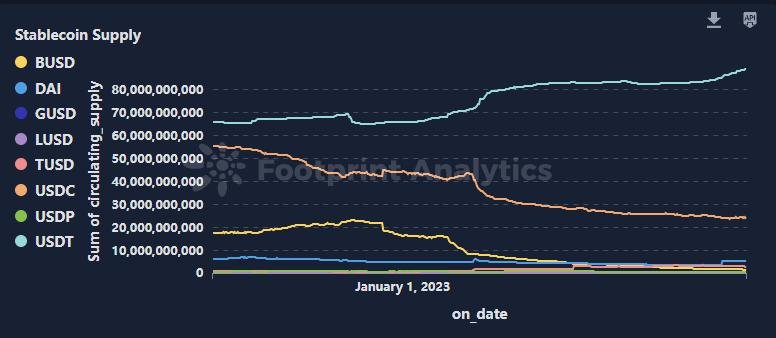

Stablecoin supply

Stablecoin supply

Stablecoin supply is a key metric for measuring the total stablecoin circulation, and its growth generally indicates improved market liquidity, which is a positive sign for the cryptocurrency space.

Take stablecoins like USDT and USDC, which are pegged to the U.S. dollar, for example. The supply of these stablecoins directly reflects market demand. According to the principle of supply and demand, an increase in demand exceeding supply may push currency prices up, while excess supply may lead to the risk of currency prices falling. To maintain stability, issuers must dynamically adjust supply in real time based on market demand.

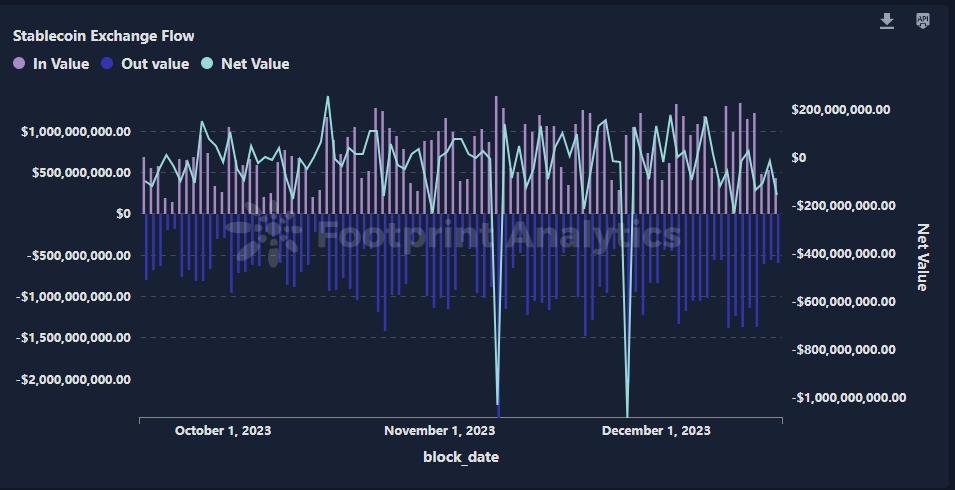

Stablecoin exchange flows

Stablecoin Trading Liquidity

The entry and exit of stablecoin trading proceeds is an important indicator of the cryptocurrency market. It can provide insight into the movement of stablecoins in and out of exchanges, thereby tracking investors' buying and selling activities.

When stablecoins flow into exchanges, it signals that investors are ready to buy cryptocurrencies, often signaling an upcoming bullish market trend. Conversely, when stablecoins flow out of exchanges, it indicates that investors are reducing their holdings of cryptocurrencies and may signal a bearish market trend.

Leave a comment

Your email address will not be published. Required fields are marked *